Original article published by RealTrends

The California housing market has been in the news a lot lately. With the slowdown in transaction sides and sales prices below both 2022 and 2021 levels, it’s easy to see why — but slower sales and price drops aren’t the only metrics worth examining.

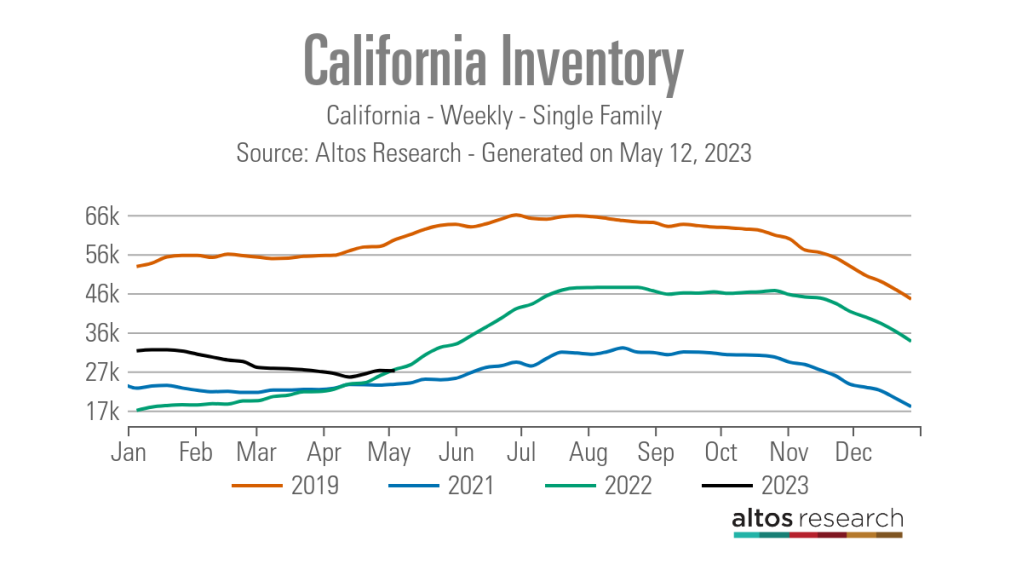

As of May 6, the inventory of single-family homes for sale statewide was at 26,627 homes, slightly below where it was exactly a year ago (26,994 homes) and well below early May 2019 inventory levels, which came in at over 60,000 homes, according to data from Altos Research.

“It is very different from what we saw in the fall,” Ryan Lundquist, a Sacramento County-based residential real estate appraiser and market analyst, said. “It is like the market went from an ice bath to a blood bath — it is very competitive and buyers are feeling frustrated at the lack of options.”

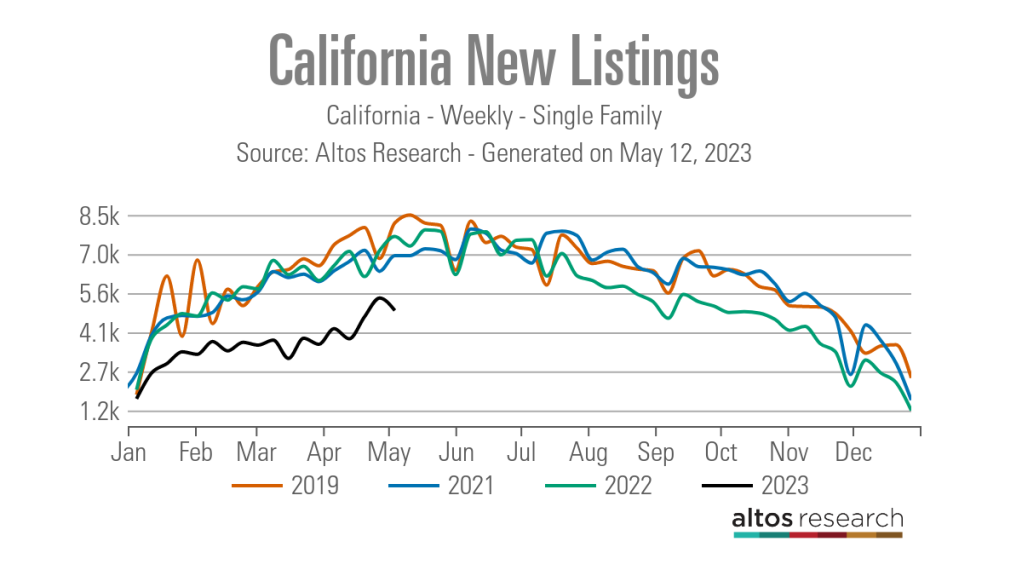

And it appears that the low inventory situation won’t be ending any time soon, as the number of new listings coming to market is also well below where it was last year. During the week ending May 6, 4,942 new listings of single-family homes came to market in California. A year ago, 7,684 new listings came on the market during the same week, and in 2019, 8,188 new listings were added, according to Altos.

“This time last year inventory was rising super quickly as demand was starting to cool way off,” Mike Simonsen, the president of Altos Research, said. “Any potential sellers in 2022 were rushing to get to market before the big catastrophe hit that everyone could see coming. Given how the trend went last year in California, I was expecting inventory to start rising right away again, but the opposite has happened and now we are at fewer homes than a year ago.”

For Simonsen, the “big catastrophe” last May was the impending Federal Reserve interest rate hike. The rate hike came in mid-June with the Fed raising rates by 75 basis points, the largest single rate hike since 1994, in an attempt to help curb inflation.

While inflation has continued to plague the U.S. economy, the Fed’s rate hikes through the second half of 2022 had a chilling effect on the housing market, best illustrated in the dramatic downturn in existing home sales.

After posting a 6.5% month-over-month increase in January to a sales pace of 6.65 million homes, existing home sales trended downward throughout the rest of the year. Existing home sales ultimately finished out 2022 with a 1.5% month-over-month decrease in December to a seasonally adjusted sales pace of 4.02 million, according to data from the National Association of Realtors.

“Post 1996, with where mortgage rates have gone, and our civilian labor force growth, it’s been scarce to have monthly existing home sales go below 4,000,000,” Logan Mohtashami, HousingWire’s lead analyst, said. “The only time we really broke under 4,000,000 was in 2008. We broke it briefly after the 2010 home buyer tax credit expired. During Covid19 we broke toward 4,000,000 and stopped. Of course, last year, which was the most significant one year collapse in sales ever.”

Housing professionals across the state are placing the blame for the current inventory situation on these Fed rate hikes and the mortgage rates they produced.

“Sellers backing off the market is the ‘X Factor.’ It is really the consequence of Fed policy,” Lundquist said. “You have a whole host of potential sellers where the math just doesn’t work right now. They either can’t afford to buy with purchase prices and mortgage rates so high or they are so comfortable with a low payment where it doesn’t make sense to move unless you have some sort of life event that is forcing you to move.”

In Lundquist’s home base of Sacramento County, there were 860 single family homes on the market as of May 5, down from 1,079 homes a year ago, according to Altos.

“We have a really weird dynamic right now. For six months in a row in Sacramento County, we’ve seen sales volume worse than 2007 levels,” Lundquist said. “But it feels like 2020 in terms of competition. The wild part is we have about one month of housing supply today. In contrast, in 2007 we had 10 months of supply. So, we are getting similar results with volume, but the market feels completely different.”

Up in Humboldt County, eXp Realty agent Tracie Creps is experiencing something similar.

“I am in a position where I had planned on selling my home, but I have a 2% mortgage rate,” Creps said. “I really wanted to get out of my neighborhood and find something else, but it just isn’t worth it right now. I think a lot of people are in the same situation, comfortable with where they are, but people are still moving because life happens.”

Creps said this lack of motivation to sell unless owners are selling out of necessity creates a vicious cycle.

“Even if I were to put my house on the market right now, there is nothing for me to buy until more inventory comes on, and I don’t think that is going to change for a while, so it makes it really hard for people that want to sell,” Creps said.

As of May 5, there were 258 single family homes listed for sale in Humboldt County and just 40 new listings, according to data from Altos Research.

With supply this low, Creps said it is common to see bidding wars, as well as for homes selling for over list price.

“Over the winter the days on market were higher, and even in March it was still around 40 days, but now we are down to 18 days,” Creps said. “The last two homes I put on the market had multiple offers. They were in an affordable price range, but everything is just moving so much faster.”

Tracy Do, a Coldwell Banker agent in Pasadena, is facing similar challenges to Creps.

“There are not enough homes for buyers in the market. Starting late last year and into 2023, I am speaking with homeowners who are thinking of selling, but many reconsider because as buyers they will face higher interest rates, versus the low rate that they locked into now in their current home,” Do said. “For folks who are borrowing to purchase, which is most prevalent, their purchasing power is reduced. Some are weighing whether to make an addition to their existing residence, as an alternative to selling and moving. As long as there are very few sellers, buyers will have to choose and compete from this limited supply.”

As of May 6, 2023, there were just 77 single-family homes for sale in Pasadena, a city with a population of over 135,000.

In Los Angeles, which had 1,086 single family homes on the market as of May 10 — the most of any city in California — inventory is tight, and agents don’t expect things to get better any time soon.

“There is very low inventory, especially in the more affordable, entry-level markets,” Michael Nourmand, the president of Nourmand & Associates, said. “Buyers are getting a bit more used to the higher mortgage rates and have come to terms with the fact that they might not see 3% rates any time soon, so the ones who maybe put their search on hold for a bit are coming back.”

While Nourmand feels higher mortgage rates are holding some sellers back from listing, he believes that eventually sellers will come around.

“People want to enjoy their lives, and sometimes that means that you do things that don’t make the most sense financially,” he said.

However, Gretchen Pearson, the broker-owner of Berkshire Hathaway HomeServices Drysdale Properties, is hopeful that things may at least slightly improve in the northern half of the state in the coming months.

“I have one broker out in the East Bay Area who in the next 45 days is bringing on 21 listings, another up in the Truckee market bringing on 18 listings in the next 30 days, and an agent out in San Francisco that is bringing on nine in the next 30 days,” Pearson said. “I’m not sure if this is just a summer fling or some of the demographic factors I have been talking about coming into play.”

Despite all the inventory that Pearson’s agents have coming to market, she says it will not even come close to satiating demand, a sentiment Creps, in Humboldt County, shares.

“It seems like more homes are going pending than listed every day, so it is going to be hard to make up that inventory,” Creps said. “I don’t see us making up the inventory this summer for sure.”